Pensioners have benefited from an 8.5% increase in the State Pension. While the boost is likely to be welcomed by many, the full new State Pension is nearing the Personal Allowance threshold. As a result, some retirees might need to consider their Income Tax liability for the first time or could be pushed into a higher tax bracket.

The full new State Pension is £221.20 a week in 2024/25

Under the triple lock, the State Pension increases each tax year by the highest of the following three measures:

- Average wage growth

- Inflation

- 2.5%

The triple lock plays an important role in preserving the spending power of pensioners. If your State Pension income remained the same throughout retirement, it would gradually buy less as the cost of goods and services increased. As you could claim the State Pension for several decades, the triple lock might play an essential role in maintaining your lifestyle.

For 2024/25, the full new State Pension increased by 8.5% (the average wage growth measure) to £221.20 a week, or £11,502 a year.

To be entitled to the new full State Pension, you need at least 35 qualifying years of National Insurance contributions or credits. If you have fewer qualifying years, you’ll usually receive a portion of the full State Pension but you still benefit from the triple lock.

If you reached the State Pension Age before 6 April 2016, your State Pension is based on the old rules that existed at that time. You might receive a lower amount if you were contracted out of the Additional State Pension.

You can use the government’s State Pension forecast if you’d like to understand how much you could receive through the State Pension and when you can claim it.

Frozen allowances could mean your tax bill increases in retirement

The government has frozen key Income Tax thresholds at 2021/22 levels until April 2028. As a result, more people are expected to pay Income Tax in the coming years as wages and the value of benefits such as the State Pension rise.

Indeed, the Office for Budget Responsibility (OBR) predicts the freeze will lead to 3.2 million new taxpayers and 2.1 million new higher-rate taxpayers by 2027/28. It’s not just an issue for workers – it could affect retirees too.

The Personal Allowance – the amount of income you can earn before tax is usually due – is £12,570 in the 2024/25 tax year, and it’s expected to remain at this level until 2028.

The latest rise under the triple lock means most of your Personal Allowance could be used by the State Pension if you’re entitled to the full amount. You’d only need to receive around £90 a month from other sources before you become liable for Income Tax. As a result, some people who haven’t paid Income Tax since retiring could now face an unexpected bill.

Similarly, the tax thresholds for paying the higher and additional rate of Income Tax are frozen until 2028. So, even if your income from other sources doesn’t increase, you could find yourself in a higher tax bracket due to the State Pension rise.

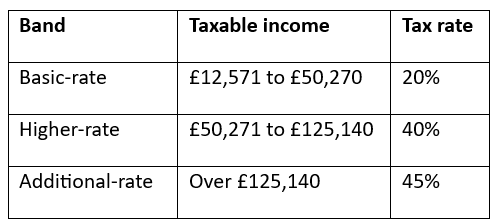

For 2024/25, the Income Tax bands are:

How to manage your tax liability in retirement

To manage your tax liability in retirement, one of the first steps is to track your income – are you nearing any thresholds that could lead to a higher bill than expected?

You might have several different income streams you need to consider, such as the State Pension, annuities, or flexible withdrawals from your pension.

Once you’ve set out your income, you can start to create a tax strategy that suits your needs.

For instance, you can usually take up to 25% of your pension as a tax-free lump sum (for most people this will be capped at a maximum of £268,275 in 2024/25), which you may spread across multiple withdrawals. This could be a useful way to access large amounts without increasing your tax bill. However, once you exceed the tax-free amount, the money you withdraw as a lump sum would usually be added to your other taxable income and could be taxed.

As a retiree, you may be in control of your income sources and could adjust them to reduce your tax liability. For example, if you take an income from your pension using flexi-access drawdown, you might choose to lower the amount so you remain below an Income Tax threshold.

You might also choose to supplement your income from other tax-efficient sources, like an ISA. An ISA offers a tax-efficient way to save and invest, so you might make withdrawals to support your day-to-day costs without increasing your tax liability.

Contact us to talk about how to improve your tax efficiency in retirement

If you’d like to understand what steps you could take to improve tax efficiency in retirement, we could help. We’ll take the time to understand your goals, lifestyle, and assets and then work with you to create a retirement plan that’s tailored to you. Please contact us to arrange a meeting.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future performance.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates, and tax legislation may change in subsequent Finance Acts.