Given the considerable uncertainty that is being created around the rapid spread of Covid-19 (coronavirus), we thought you would appreciate an update on our position and contingency plans.

Currently, the Otter Financial Services Office remains open, but we are closely monitoring the general situation and following the advice given by the relevant authorities. We have therefore prepared for various eventualities and scenarios. This includes remote working to help minimise any risk while keeping the business operating as normally as possible in this difficult time. Although we never expected to use it, we had already prepared a robust business continuity plan.

The nature of our business means we are well placed to carry on business as usual remotely and we are not reliant on having to use the office to continue serving our clients.

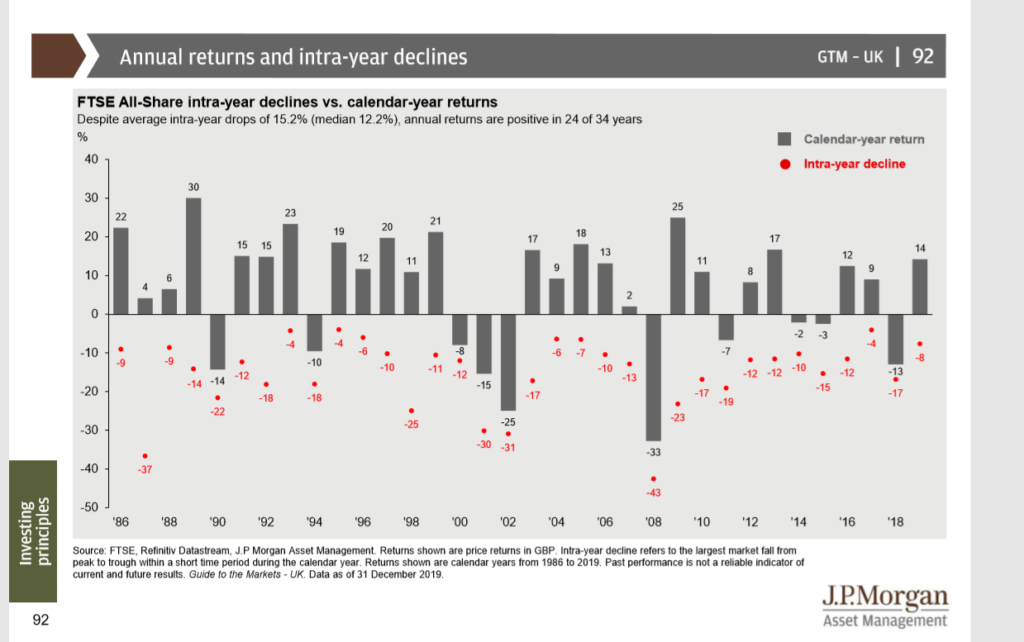

To demonstrate, the following chart shows the annual calendar year returns and intra year declines of the FTSE All Share since 1986. The red figures show the ‘intra year’ decline or the figure by which the index dropped in that calendar year at some point.

The key message here is despite an average intra year loss of 15.2%, annual returns are positive in 24 of the 34 years.

The ebbs and flows, and highs and lows, of stock markets are perhaps the only thing we can safely say are a given. Invest for long enough and you will experience markets rip-roaring at their peaks one minute, to then suddenly come hurtling down before anyone can sound the warning bell. The ‘when’ is unknown, as too is the ‘why’, but we know they’re inevitable. Since 1975, the UK stock market has fallen by 20% or more on nine occasions. Each time, it has gone on to record new highs and considerably higher stock market valuations in following years. That’s once every five to six years. Yet, every time it happens, it feels brand new and hurts just the same.

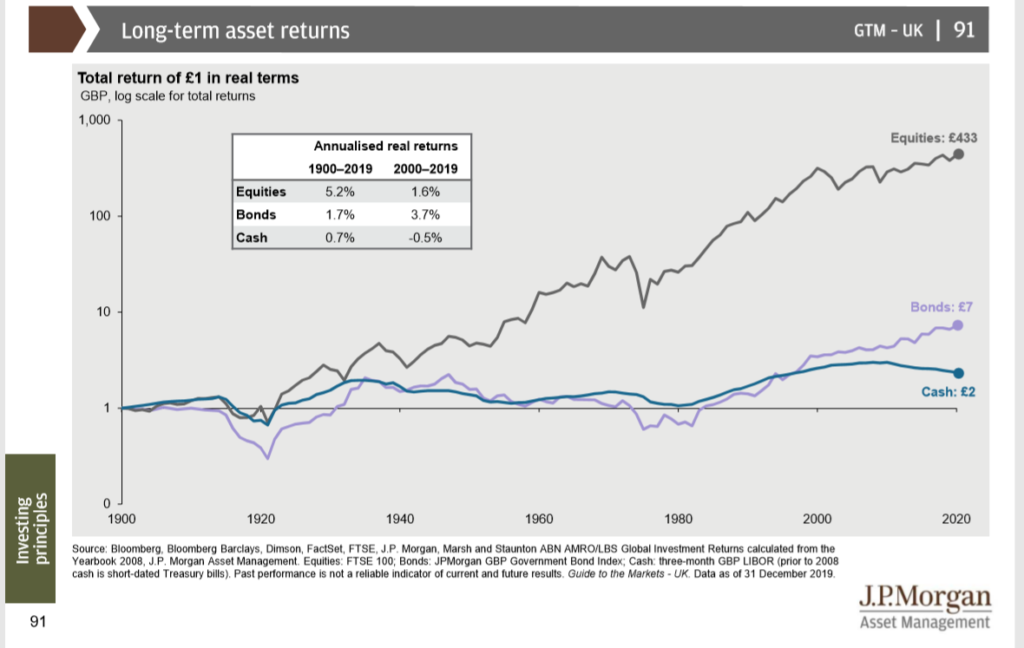

The following chart shows the long term returns of various asset classes.

The key message here is to accept market corrections as part of the journey. As a necessary evil that sees markets regroup and recalibrate ready for a new phase of growth. Being invested in equities is the dominant factor for real returns over time.

All this said, undoubtably you will still have questions and be concerned for the future. The language being used in the press will no doubt be very bleak, but that is also to be expected. After all, bad news sells, and journalists have a wonderful way of making bad times seem a whole lot worse.

Rest assured, we will be very aware of every movement, but at the same time I urge you not to overreact to what can often just be noise.

Working together we have created your individual long-term financial plan and market events like we are currently experiencing have been factored in. However, should you need further reassurance, please also find attached our guide ‘top tips for staying calm in today’s market’.

We are in this together. Indeed, my own family’s wealth is invested using the same investment philosophy. Therefore, I remain confident that this remains robust and we have been through many times like this before. Please remain focused and rational, and we will do everything we can to deliver the best possible outcomes for you and all our clients.

Over the coming weeks and months, you will be bombarded with news flow, therefore, I wanted to remind you that I am here for you if you have any further questions or concerns.

As mentioned earlier, for the time being it is business as usual and we remain happy to meet with clients in person at our offices. However, should you feel uncomfortable with this we can postpone any upcoming meeting and rearrange, or we can speak over the telephone or via video call.

We will continue to follow the advice issued by the government and NHS and will keep you updated with our plans. In the meantime, please stay safe and remain vigilant, and be reassured that your financial affairs are in safe hands.